What?

The Social and Environmental Rating offers an expert opinion on a financial institution’s ability to implement its mission and accomplish its social and environmental goals. It involves an independent assessment of the institution’s social and environmental performance.

Why?

It serves as an effective management and reporting tool, fulfilling the following key purposes:

- Enhance social and environmental performance management, reduce the risk of mission drift by identifying gaps, and indicating improvement areas

- Align with Universal Standards of Social and Environmental Performance Management Standards (USSEPM), meeting internationally recognized standards

- Attract founders and investors with a double bottom line orientation

- Strengthen institutional reputation, accountability, and transparency

MFR clients find the Social Rating beneficial for two main reasons, as reported by MFR customer care in December 2019:

Who?

All financial service providers engaged in financial inclusion with a double bottom-line, irrespective of their legal status and size. If you are a SME financial service provider, click here.

How it works?

The Social and Environmental Rating is fully aligned with the latest social performance standards as defined by global initiatives such as the Social Performance Task Force and the Cerise+SPTF Client Protection Certification. By incorporating such standards, it provides:

- External expert validation of the implementation of the Universal Standards for Social and Environmental Performance Management

- An indication of the FSP‘s alignment with Client Protection Certification standards and of the level of effort required to fill compliance gaps

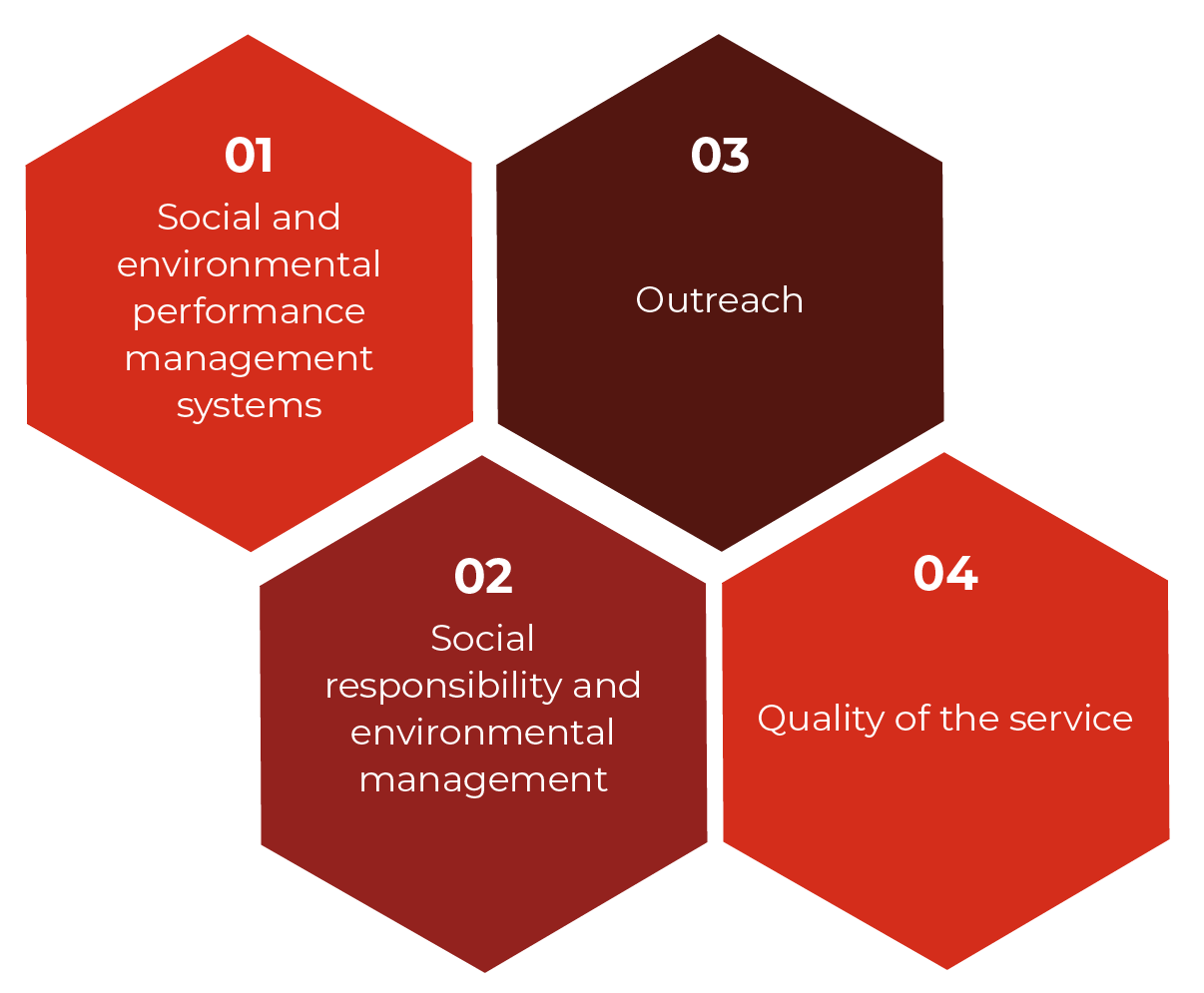

Explore the framework of our Social & Environmental Rating in the graphic below, illustrating the key areas of analysis:

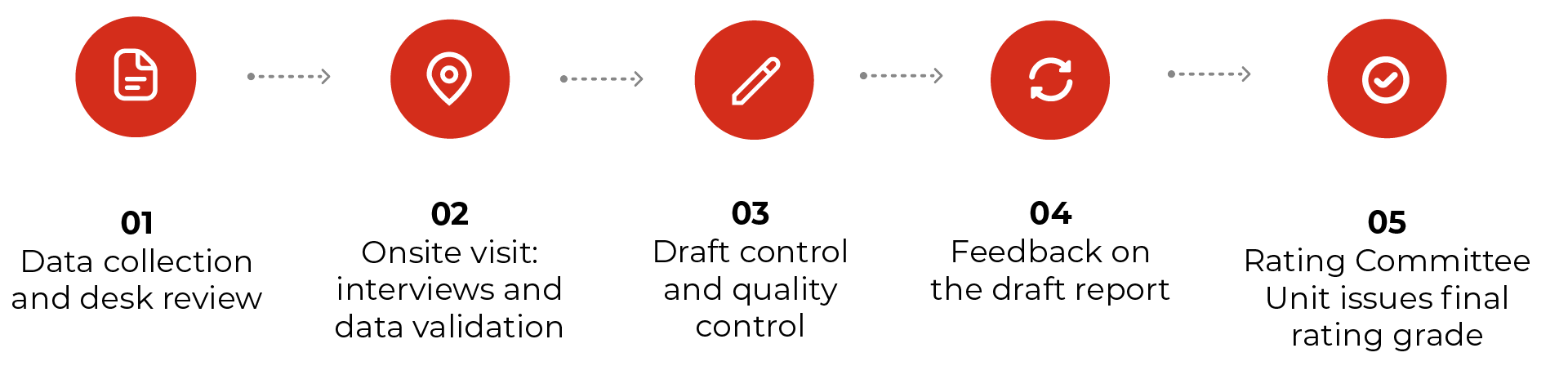

Process

Add-on Services

Financial Service Providers willing to further deepen the analysis of their results or strengthen their performance management can easily combine the Social and Environmental Rating with other related services, such as: