What?

MFR offers an independent and confidential due diligence (DD) service fully customized to investors’ objectives, criteria, methodologies and tools. MFR’s due diligence service benefits from MFR’s expertise as a rating agency and is designed to respond to investors’ needs of lean reporting.

Why?

To facilitate investment decisions and deal sourcing.

Who?

All investors engaged in inclusive finance and impact finance.

How it works?

The due diligence service can be fully customized to the investor’s objectives, criteria, methodologies and tools. Upon request, MFR can assist with fine-tuning selection criteria for future financial partners/investees. The scope of the due diligence process depends on the investor’s preference and may include assessment of the potential investee’s/financial partner’s financial, risk and strategic profile and validation of the information to be used in investment decision making. The due diligence service usually involves an onsite phase, but the approach can be tailored to specific needs.

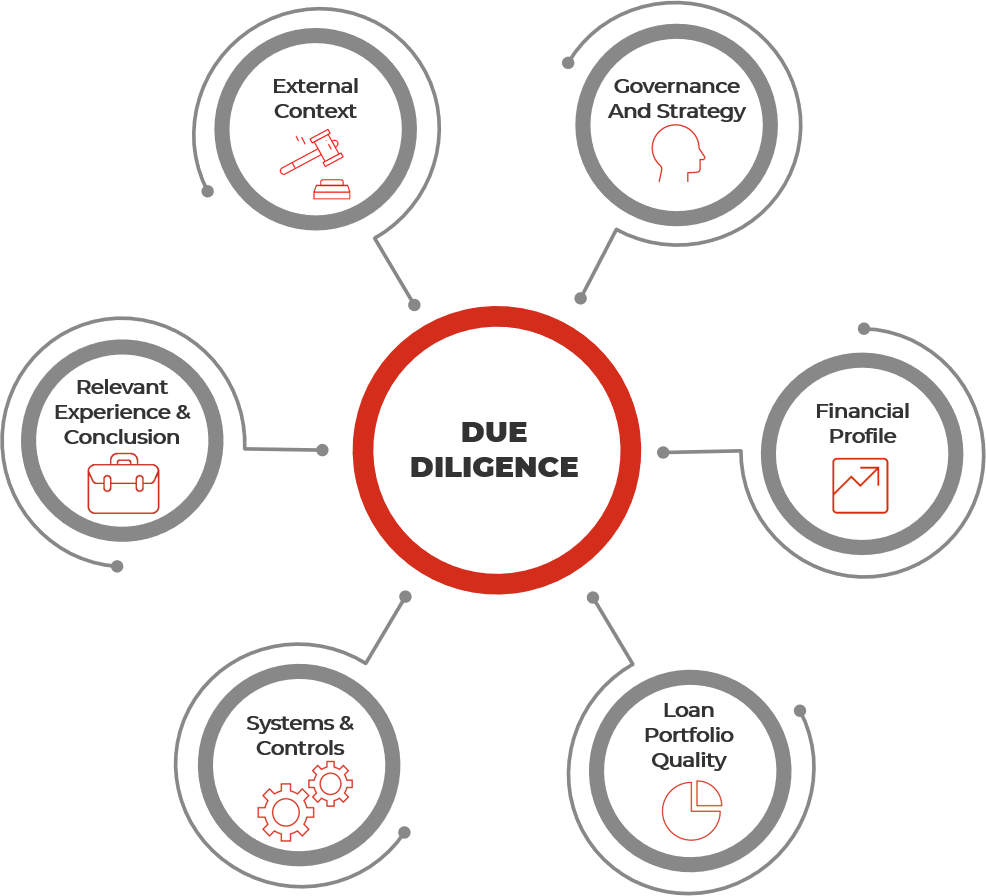

Example of areas of analysis

Process

Add-on Services

| PORTFOLIO MONITORING (off-site or on-site) | OFF-SITE PRE-SCREENING of financial services providers based on eligibility criteria to optimize DEAL SOURCING |

| COMPARATIVE REPORT in case of several financial service providers undergoing due diligences | TECHNICAL ASSISTANCE NEEDS ASSESSEMENT |